Reading Time: 5 minutes

Financial management is critical to running a successful business. From tracking income and expenses to managing cash flow and making strategic investments, one of the most important financial reports you’ll rely on is the statement of financial position, also commonly referred to as a balance sheet.

The statement of financial position provides a snapshot of your business’s financial health at a specific time. It lists your assets (what you own), liabilities (what you owe), and equity (the interest in the assets after deducting liabilities).

This information is crucial for understanding your company’s financial standing, making informed decisions, and demonstrating accountability to stakeholders.

In this blog post, we’ll discuss the statement of financial position and how to use it, as well as provide an example to illustrate its importance.

Whether you’re a small business owner, freelancer, or accountant, understanding the statement of financial position is essential for effectively managing your finances.

Components of the Statement of Financial Position

The statement of financial position is divided into three main components: assets, liabilities, and equity. Let’s take a closer look at each component using an example:

Jane Okeke is a successful make-up artist with over 5 years of experience working with several clients in Ohio. She maintains a personal statement of financial position to track her assets, liabilities, and net worth over time.

Statement of Financial Position for Jane Okeke

| Statement of Financial Position | Amount (USD) |

| Assets | |

| Current Assets | |

| Cash | 10,000 |

| Accounts Receivable | 5,000 |

| Supplies | 3,000 |

| Total Current Assets | 18,000 |

| Non-Current Assets | |

| Equipment | 10,000 |

| Intangible Assets | 2,000 |

| Total Non-Current Assets | 12,000 |

| Total Assets | 30,000 |

| Liabilities | |

| Current Liabilities | |

| Accounts Payable | 2,000 |

| Short-term Loans | 3,000 |

| Total Current Liabilities | 5,000 |

| Non-Current Liabilities | |

| Long-term Loans | 4,000 |

| Total Non-Current Liabilities | 4,000 |

| Total Liabilities | 9,000 |

| Equity | |

| Initial Investment | 5,000 |

| Retained Earnings | 16,000 |

| Total Equity | 21,000 |

| Total Liabilities and Equity | 30,000 |

Assets

Assets are resources Jane owns that have monetary value and can be used to generate cash for her business. They are typically classified as either current or non-current:

- – Current assets include liquid assets such as cash, receivables, and supplies that Jane uses for her business.

- – Non-current assets include longer-term investments such as equipment and intangible assets like a branded website or intellectual property.

Check out: What are Asset Accounts in accounting?

Liabilities

Liabilities are obligations or debts Jane owes to other parties. Like assets, liabilities are also classified as either current or non-current:

- – Current liabilities are short-term obligations such as accounts payable and short-term loans that must be settled within a year.

- – Non-current liabilities are longer-term debt, such as long-term loans, that will be paid off over a period longer than a year.

Equity

Equity represents the residual interest in Jane’s assets after deducting liabilities. It can be further broken down into:

- – Initial Investment: The amount Jane initially invested into her business.

- – Retained Earnings: The accumulated profits reinvested into the business over time.

Check out: What Is Retained Profit? How Does It Affect Your Business?

This Statement of Financial Position clearly shows Jane Okeke’s financial standing, balancing her assets, liabilities, and equity to ensure a healthy and sustainable business.

How To Use the Statement of Financial Position

The statement of financial position, or balance sheet, is a powerful tool for businesses of all sizes to understand their financial health, make informed decisions, and demonstrate accountability to stakeholders.

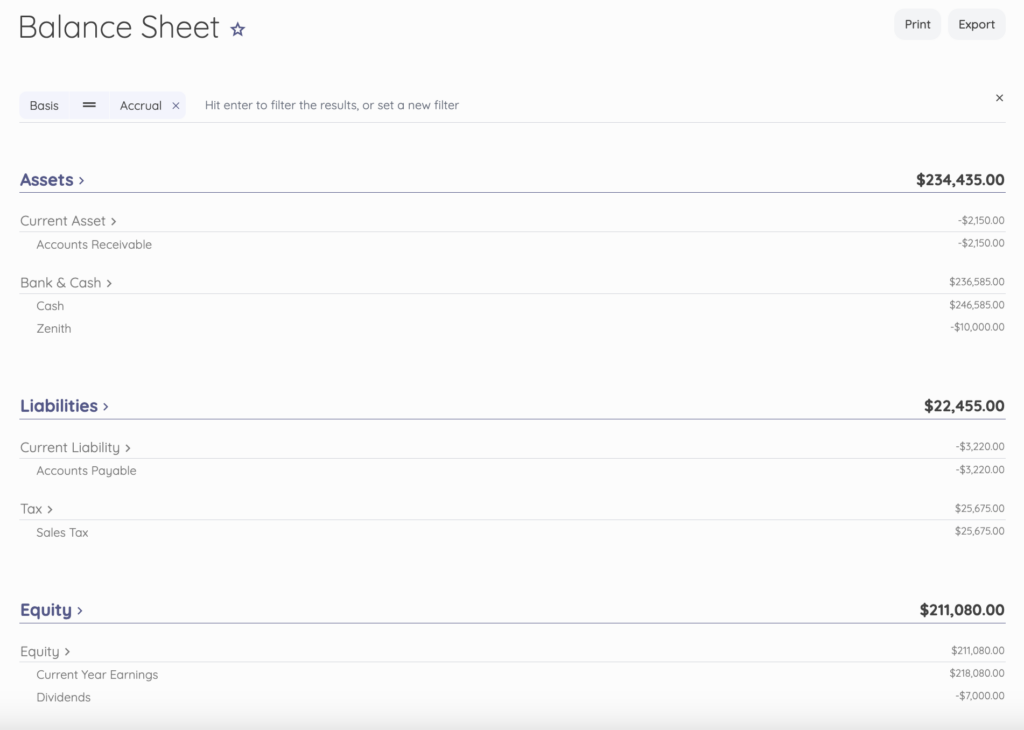

Get a comprehensive statement of financial position with Double Entry from Akaunting

Let’s explore some of the key ways businesses leverage this report:

Financial Health and Performance

The statement of financial position provides a clear picture of a business’s overall financial health and performance.

By analyzing the relationship between assets, liabilities, and equity, you can gain valuable insights into your company’s:

- – Net worth: The difference between total assets and liabilities represents your business’s net worth or equity. A positive net worth indicates financial stability and solvency.

- – Liquidity: The ratio of current assets to current liabilities (current ratio) measures your ability to pay short-term obligations. A ratio greater than 1 generally indicates good liquidity.

- – Leverage: The ratio of total liabilities to total equity shows how the business is financed by debt versus equity. A lower ratio indicates less financial risk.

Example: If a retail business has total assets of $200,000 and liabilities of $120,000, its net worth would be $80,000.

With current assets of $100,000 and current liabilities of $60,000, its current ratio would be 1.67 ($100,000 / $60,000). That value indicates good liquidity.

Check out: What is a Good Current Ratio?

With total liabilities of $120,000 and total equity of $80,000, its debt-to-equity ratio would be 1.5 ($120,000 / $80,000). That suggests a moderate level of financial leverage.

Decision-Making

The statement of financial position is a crucial tool for making informed financial decisions. Having extensive knowledge of your company’s assets, liabilities, and equity can help you:

- – Manage cash flow: Monitoring your cash and other liquid assets can ensure sufficient funds to meet short-term obligations and take advantage of growth opportunities.

- – Evaluate financing options: The statement of financial position can help you determine your borrowing capacity and negotiate better terms with lenders based on your financial strength.

- – Growth plan: Analyzing your assets and liabilities can help you identify areas for improvement and make strategic decisions about investing in new equipment, expanding your services, or pursuing other business opportunities.

For a freelance graphic designer, the statement of financial position can provide valuable insights into their personal financial situation.

Individuals can determine their net worth by monitoring their assets (such as cash, accounts receivable, and equipment) and liabilities (such as credit card balances and loans).

This allows them to make well-informed decisions about managing their finances, investing in professional development, or pursuing new opportunities.

Compliance and Reporting

The statement of financial position is an important part of financial reporting for all businesses. It serves several key compliance and reporting functions:

- – Tax filings: It is a crucial report for demonstrating compliance with tax laws and regulations.

- – Audits: Independent auditors rely on it to assess the accuracy and completeness of a company’s financial records.

- – Securing financing: Lenders and investors often require it when applicants apply for loans, lines of credit, or equity investments.

For example, a small business seeking a loan to finance a new piece of equipment would likely need to provide a statement of financial position to the lender.

The lender would analyze the business’s assets, liabilities, and equity to assess its creditworthiness and ability to repay the loan.

Conclusion

Monitoring your financial position statement regularly is important to ensure that your business maintains stable cash flow.

Keeping track of your income, expenses, accounts payable, and accounts receivable gives you a head start and helps you avoid surprises.

With Akaunting’s Double Entry, you can prepare detailed financial reports with the general ledger, manual journals, trial balance, chart of accounts, and balance sheet for informed decision-making.

The post Statement of Financial Position and How To Use It appeared first on Blog – Akaunting.