To stay relevant and competitive, payment solution providers must enhance their payment processes to adapt to changing customer expectations, regulatory demands, and advancing technologies. The imperative for modernization is clear: payment systems must become faster, more secure, and seamlessly integrated across platforms.

Driven by multiple factors—real-time payments, regulatory shifts like Payment Services Directive 2 (PSD2), heightened customer expectations, the power of open banking, and the disruptive force of fintech startups—the need for payment modernization has never been more pressing. But transformation is not without its challenges.

Complex systems, industry reliance on outdated technology, high upgrade costs, and technical debt all pose formidable obstacles. This article will explore modernization approaches and how MongoDB helps smooth transformations.

Approaches to modernization

As businesses work to modernize their payment systems, they need to overcome the complexities inherent in updating legacy systems. Forward-thinking organizations embrace innovative strategies to streamline their operations, enhance scalability, and facilitate agile responses to evolving market demands.

Two such approaches gaining prominence in the realm of payment system modernization are domain-driven design and microservices architecture:

-

Domain-driven design: This approach focuses on a business’s core operations to develop scalable and easier-to-manage systems. Domain-driven design ensures that technology serves strategic business goals by aligning system development with business needs. At its core, this approach seeks to break down complex business domains into manageable components, or “domains,” each representing a distinct area of business functionality.

-

Microservices architecture: Unlike traditional monolithic architectures, characterized by tightly coupled and interdependent components, a microservices architecture decomposes applications into a collection of loosely coupled services, each of which is responsible for a specific business function or capability. It introduces more flexibility and allows for quicker updates, facilitating agile responses to changing business requirements.

Discover how Wells Fargo launched their next-generation card payments by building an operational data store with MongoDB.

Modernizing with an operational data layer

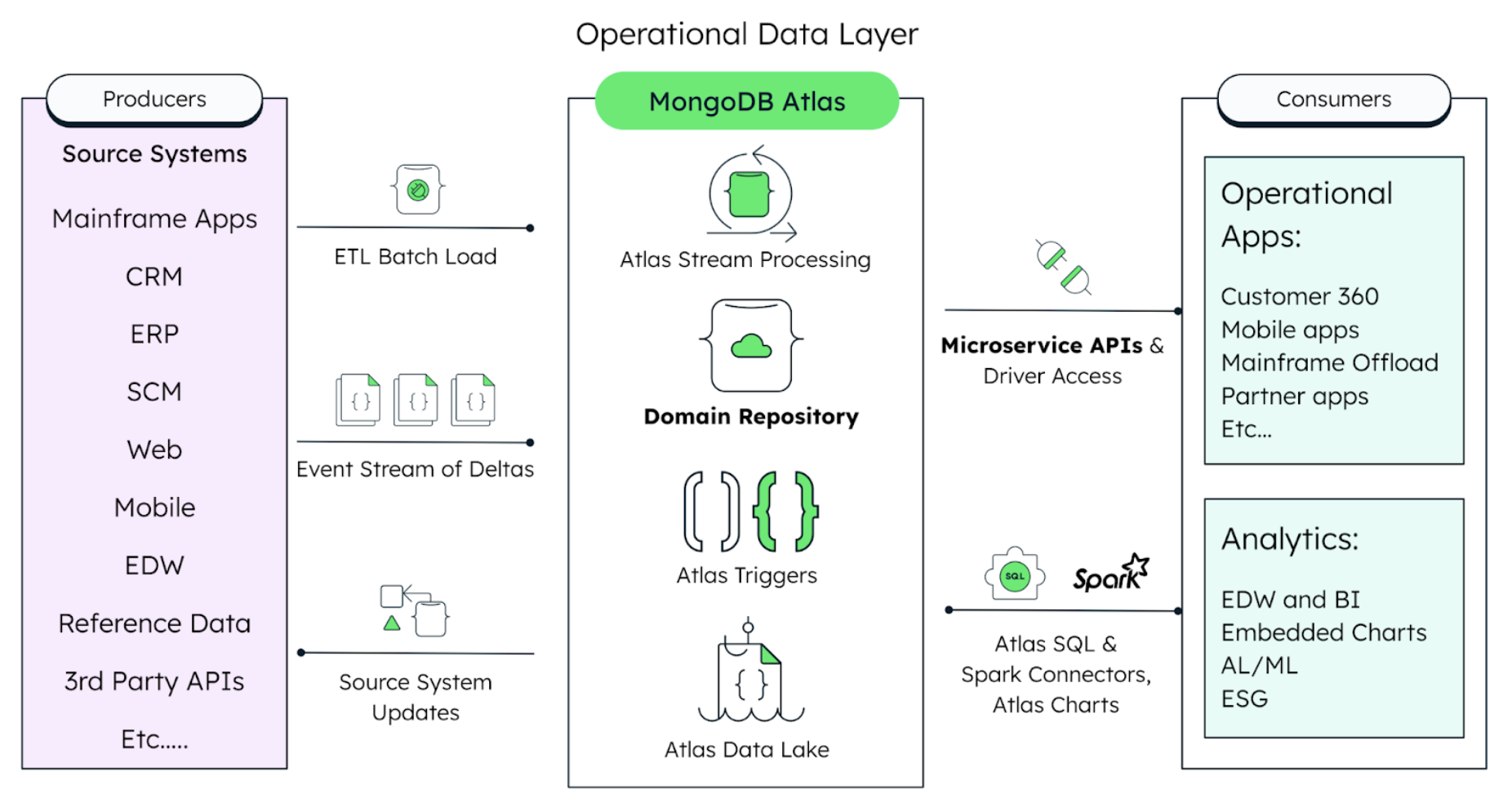

In the payments modernization process, the significance of an operational data layer (ODL) cannot be overstated. An ODL is an architectural pattern that centrally integrates and organizes siloed enterprise data, making it available to consuming applications. The simplest representation of this pattern looks something like the sample reference architecture below.

An ODL is deployed in front of legacy systems to enable new business initiatives and to meet new requirements that the existing architecture can’t handle—without the difficulty and risk of fully replacing legacy systems. It can reduce the workload on source systems, improve availability, reduce end-user response times, combine data from multiple systems into a single repository, serve as a foundation for re-architecting a monolithic application into a suite of microservices, and more. The ODL becomes a system of innovation, allowing the business to take an iterative approach to digital transformation.

Here’s why an ODL is considered ideal for payment operations:

-

Unified data management: Payment systems involve handling a vast amount of diverse data, including transaction details, customer information, and regulatory compliance data. An ODL provides a centralized repository for storing and managing this data, eliminating silos and ensuring data integrity.

-

Real-time processing: An ODL enables real-time processing of transactions, allowing businesses to handle high numbers of transactions swiftly and efficiently. This capability is essential for meeting customer expectations for instant payments and facilitating seamless transactions across various channels.

-

Scalability and flexibility: Payment systems must accommodate fluctuating transaction volumes and evolving business needs. An ODL offers scalability and flexibility, allowing businesses to scale their infrastructure as demand grows.

-

Enhanced security: An ODL incorporates robust security features—such as encryption, access controls, and auditing capabilities—to safeguard data integrity and confidentiality. By centralizing security measures within the ODL, businesses can ensure compliance with regulatory requirements and mitigate security risks effectively.

-

Support for payments data monetization: Payment systems generate a wealth of data that can provide valuable insights into customer behavior, transaction trends, and business performance. An ODL facilitates real-time analytics and reporting by providing a unified platform for collecting, storing, and analyzing this data.

Transform with MongoDB

MongoDB’s fundamental technology principles ensure companies can reap the advantages of microservices and domain-driven design—specifically, our flexible data model and built-in redundancy, automation, and scalability. Indeed, the document model is tailor-made for the intricacies of payment data, ensuring adaptability and scalability as market demands evolve.

Here’s how MongoDB helps with domain-driven design and microservice implementation to adopt industry best practices:

-

Ease of use: MongoDB’s document model makes it simple to model or remodel data to fit the needs of payment applications. Documents are a natural way of describing data. They present a single data structure, with related data embedded as sub-documents and arrays, making it simpler and faster for developers to model how data in the application will be mapped to data stored in the database. In addition, MongoDB guarantees the multi-record ACID transactional semantics that developers are familiar with, making it easier to reason about data.

-

Flexibility: MongoDB’s dynamic schema is ideal for handling the requirements of microservices and a domain-driven design. Domain-driven design emphasizes modeling the domain to reflect the business requirements, which may evolve over time. MongoDB’s flexible schema allows you to store domain objects as documents without rigid schema constraints, facilitating agile development and evolution of the domain model.

-

Speed: Using MongoDB for an ODL means you can get better performance when accessing data, and write less code to do so. A document is a single place for the database to read and write data for an entity. This locality of data ensures the complete document can be accessed in a single database operation that avoids the need internally to pull data from many different tables and rows.

-

Data access and microservice-based APIs: MongoDB integrates seamlessly with modern technologies and frameworks commonly used in microservices architectures. MongoDB’s flexible data model and ability to handle various data types, including structured and unstructured data, is a great fit for orchestrating your open API ecosystem to make data flow between banks, third parties, and consumers possible.

-

Scalability: Even if an ODL starts at a small scale, you need to be prepared for growth as new source systems are integrated, adding data volume, and new consuming systems are developed, increasing workload. MongoDB provides horizontal scale-out on low-cost, commodity hardware or cloud infrastructure using sharding to meet the needs of an ODL with large data sets and high throughput requirements.

-

High availability: Microservices architectures require high availability to ensure that individual services remain accessible even in the event of failures. MongoDB provides built-in replication and failover capabilities, ensuring data availability and minimal downtime in case of server failures.

Payment modernization is not merely a trend but a strategic imperative. By embracing modern payment solutions and leveraging the power of an ODL with MongoDB, organizations can unlock new growth opportunities, enhance operational efficiency, and deliver superior customer experiences.

Learn how to build an operational data layer with MongoDB using this Payments Modernization Solution Accelerator.

Learn more about how MongoDB is powering industries on our solution library.